Based on QuickBooks Self Employed tax year 2015 subscribers that have identified >$0 in business expenses and of those users that have >$0 in tax savings and have logged between >0.

. Pros Exceptional user interface and navigation.

Easily tracks expenses and income. Automatic mileage tracking. Can assign business transactions to Schedule C categories. Estimates quarterly income taxes. OCR capability. Cons Lacks direct integration with e-commerce sites.

No data records, time tracking, project tracking, or recurring transactions. Invoices not customizable or thorough. No estimates or sales tax. Bottom Line The simplicity of online accounting service QuickBooks Self-Employed may make it a good fit for some freelancers and independent contractors, but others will miss standard features like time tracking, project tracking, and estimates. QuickBooks Self-Employed is a simple, inexpensive. Designed for freelancers, independent contractors, and home-based entrepreneurs, QuickBooks Self-Employed connects to your financial accounts and imports transactions, tracks mileage, creates and sends invoices, and estimates quarterly taxes. We reviewed the site earlier this year as we examined invoicing websites and found that Intuit had revamped the service's user interface and added reports, accountant access, and invoicing features.

Otherwise, however, QuickBooks Self-Employed doesn't do quite as much as accounting websites aimed at similar markets, though it's good at what it does do. Our top pick for small-scale accounting is FreshBooks, which costs and offers more. QuickBooks Self-Employed doesn't offer true double-entry accounting like does, but considering it has an excellent companion app, it could serve many of today's mobile microbusinesses well.

Like other Intuit financial applications, QuickBooks Self-Employed uses an easily understandable navigation system and offers an exceptional user experience. Supporting Android, Mac, iOS, and Windows, the simple interface lends itself to an easy transition between using it on a desktop or on a mobile device, so it's an attractive choice if you want this kind of interoperability.

Quickbooks For Mac Computers

Getting Connected QuickBooks Self-Employed helps you get started by displaying a lengthy series of scrolling tabs that suggest setup tasks you can perform. These include payments, completing your tax profile, and scanning a receipt. You can turn off each of them individually, but you can't shut down the whole process until you've seen all of the suggestions. If you do opt out of them, you can always find them later in the settings. It doesn't really make any sense to use the service unless you're going to regularly connect to your online financial accounts and import transactions. Once you've entered login information for one or more accounts, you're halfway there. QuickBooks Self-Employed uses the transactions it has downloaded to help you track income and expenses, and to estimate your quarterly taxes.

GoDaddy Bookkeeping also helps you stay ahead of the game when it comes to. An Effective Layout QuickBooks Self-Employed's homepage, its dashboard, is just right. Without any scrolling, you can see six graphs that provide an overview of your most important numbers: Profit and Loss, Expenses, Accounts, Invoices, Mileage, and Estimated Tax.

Click on any active area of the graph to drill down to original record keeping. Outstanding tasks, most often Transactions to Review, appear above these charts. A vertical toolbar to the left contains navigation links to Transactions, Miles, Taxes, Reports, and Invoices.

Buy Quickbooks For Mac

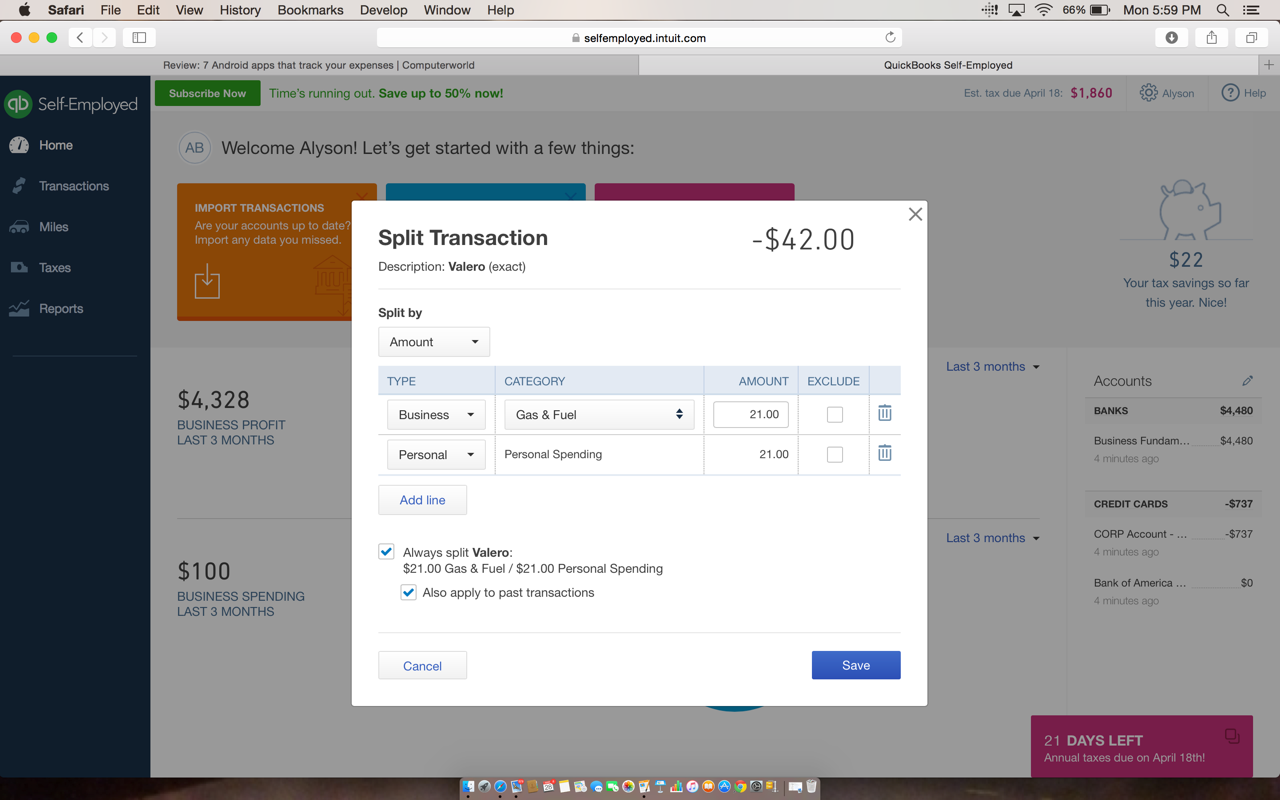

Clicking the gear icon in the upper right opens the site's Settings, and a Help link sits to the right of it. The Transaction screen shows you expenses and income for a time period you can choose out of a drop-down menu. You can import these from bank and credit card accounts if you set up this import function. QuickBooks Self-Employed lets you specify whether an item is business, personal, or a slip between the two.

You can enter receipts by photographing them with your smartphone and Intuit will extract the data using OCR. Intuit has been using this approach with for several years now and it works well. All of the internal working screens use familiar conventions, and completing tasks generally takes no explanation. As with all Intuit software and websites, the user experience is exceptional. Working with finances is no fun, but QuickBooks Self-Employed at least makes it aesthetically pleasing and intuitive. Morning Transactions The Transactions page is the heart of the QuickBooks Self-Employed experience.

There's a 12-month bar chart at the top of the Transactions page that displays your business income, spending, and profit. Below that are three filtering tools.

You can view all your transactions, only those of one type (business, personal, or unreviewed), and your accounts. To the right of those filters is a search tool.

The rest consists of a register-type display of the transactions you've downloaded and entered manually. The Transactions page works well considering the scope of the site, though it's not as comprehensive as Wave's offering. Its columns display Date, Transaction, Amount, Type, and Category. The Category designation is important, since the category you select eventually appears on your Schedule C report. Here's how it works: Let's say one of your downloaded transactions is a monthly subscription fee for a web service.

The name of the vendor appears first, after the date. The amount appears in the next column. To the right of that are three boxes marked Business, Personal, and Split.

Since it's a business expense charged by one vendor, you'd click Business. QuickBooks Self-Employed uses intelligence to select the appropriate category, which in this case is Apps/software/web services. But it's not always right.

You can be more specific than that if you so desire. Click your chosen category, and a box opens containing your most often used categories. If it's not there, click Show All Categories and select the correct one from that list. A small link marked Add Rule appears once you select a category. Click it, and a small window opens, helping you to easily teach the site how to categorize matching transactions whenever they appear. You can even have the rule apply to past transactions, which is unusual in this class of applications, though supports this ability, too.

You can also attach a receipt from a file on your computer, add a note, or exclude transactions. QuickBooks Self-Employed uses technology to extract the data from photos of receipts you've snapped on your smartphone; it then enters the relevant details in the correct fields on the site. Intuit has implemented this technology well, but it's not always 100 percent successful. Mobile Miles, Mobile Apps If you drive for work and can deduct the mileage, you can enter that specific expense by clicking the Miles link in the left vertical toolbar. You can then describe your vehicle by clicking the arrow next to the Add Trip button in the upper-right corner. When that's done, click Add Trip and enter your starting and ending addresses, the total miles, and the trip's purpose.

Quickbooks On Mac Problems

The QuickBooks Self-Employed website keeps track of your mileage deduction. However, this is much easier to manage using the service's mobile app, which tracks your mileage for you automatically as you drive. No other accounting service we've reviewed does that. QuickBooks Self-Employed's mobile app lacks little—if anything—found on the browser-based version. It's the best companion app we found in this group of accounting websites designed for freelancers. From invoices to mileage tracking to estimated taxes to reports to interactive help, it's all there. Like other Intuit applications, the user experience is exceptional.

There's a QuickBooks Self-Employed and an, so no matter which platform you're on, you can do your books on the go. Calculating Estimated Taxes If you didn't already do this when you were visiting Settings, click the gear icon, then Tax profile. You'll need to provide some important personal details (marital status, dependents, and so on) so the service calculates your estimated taxes correctly.

Once you've been working with QuickBooks Self-Employed for a while, your categorization and data entry work will begin to pay off. Click the Taxes navigational button to the left, and QuickBooks Self-Employed breaks down your calculated payments by four quarters.

Click a quarter to see the numbers for your taxable income, deductions, and projected profit for the rest of the quarter. You'll also see any estimated payments you've already paid to the IRS.

QuickBooks Self-Employed provides three reports that you'll use when you're nearing a tax deadline. One is an accounting of all the receipts you've entered. You can't simply view this report; you must download it. The second, Tax summary, displays your total taxable business profit and your deductible spending by Schedule C classification. The third, Tax details, is a downloadable Excel spreadsheet that contains more detailed tax-related transaction information.

Other sites do not require you to download reports, instead just letting you open them. Billing and Invoicing QuickBooks Self-Employed doesn't offer many options.

You can't change the lone invoice format, but you can upload a logo if you have one. You can also specify the name, address, phone number, and email address of both your business and, if it isn't already contained in the contact files (if you let Intuit access those), the same information for your customer. QuickBooks Self-Employed also doesn't handle sales taxes.

You can't pre-specify a variety of tax rates, and there's no interface to a sales tax service such as. You simply have to calculate any sales taxes due and, worse, do it as a line item. That's far from optimal, but considering the service's target customer, we don't think it will be a deal breaker in most instances.

Still, while you can't do much with invoices, they are easy to create due to their simplicity. A Simple Service QuickBooks Self-Employed lacks some of the features that competitors offer, like project and time tracking, item and contact records, sales data exchanges with sites like eBay, and recurring transactions. Still, the service has carved out a niche for itself as an inexpensive, easy-to-use set of tools for a growing market: freelancers or independent contractors who work for themselves full-time or have side hustles. Those individuals need to watch their finances carefully and get assistance preparing for estimated taxes four times a year. The service provides a user experience rivaled only by that of FreshBooks, and its automatic mileage tracking may appeal to frequent travelers.

Beyond that and the income tax help, there's really no compelling reason to go with QuickBooks Self-Employed. Many sole proprietors could get by with ' $15-per-month level, which is only $5 more than QuickBooks Self-Employed's regular price. And FreshBooks does so much more in every possible area, including invoicing, time-tracking, and income/expense management. It earns its Editors' Choice this year. One advantage to using an Intuit solution, though, is that you can upgrade to an application that's more sophisticated while staying in the same product family. The next step up from QuickBooks Self-Employed is, which is our Editor's Choice for small business accounting again this year. It offers much more in every possible way, while maintaining the same exceptional user experience found in its more junior version.

. Get our Emails Never miss another great coupon. Save more than before with savings alerts and new offers delivered right to your inbox. Coupons.com Mobile App Save effortlessly with paperless coupons! Link your store loyalty cards, add coupons, then shop and save. Coupon Codes Shop online with coupon codes from top retailers. Get Sears coupons, Best Buy coupons, and enjoy great savings with a Nordstrom promo code.

About Us Find out more about how Coupons.com helps brands and retailers engage consumers with our portfolio of digital, social & mobile solutions.